Hello everyone, it’s Chloe from Red River West. Today, I’d like to talk about Spanish startups and their expansion into the US market. At Red River West, we are a transatlantic VC fund dedicated to investing in European startups to help them scale the US in order to become global leaders. So far, we've invested in startups across several European countries, including France, Belgium, Germany, and Austria, and we're also keeping a close eye on Spain, as we believe the Spanish market is maturing rapidly and holds tremendous potential for exciting opportunities in the near future.

This strong conviction on the Spanish market has led us to partner with Gonzalo Torres, Spanish Country Lead for Shopify as a Venture Partner in Spain and with our Venture Scout Oscar Ruiz de Gopegui to be the closest possible to these promising startups. Like many European VCs based outside Spain, we understand the importance of having a local connection, which is why many of Europe’s top VCs have hired a partner or scout based in Spain.

Spain is climbing the European VC investment rankings

When talking about Europe's VC scene, the usual big players - UK, France, and Germany - come to mind first. But did you know that Spain ranked 7th in VC investment in 2023, beating out countries like Norway or Denmark? Last year, Spanish startups actually raised €2.2 billion across 764 rounds. And if we look at this particular number of rounds, Spain actually comes in 4th, just behind the big three. (Source: ‘The Spanish Tech Ecosystem Report‘ by Dealroom). This suggests the potential of Spanish startups, even though this potential is just beginning to be captured by Venture Capital firms and the ecosystem is still nascent.

This really shows how far Spain has come in recent years, becoming one of Europe’s most exciting and promising startup ecosystems. We've already seen some big wins, with unicorns emerging and expanding globally such as TravelPerk, Factorial, Job&Talent... Tackling the US market in particular isn’t easy, but more and more Spanish companies are stepping up to the challenge—16% of the most well-funded startups in Spain are either planning to expand to the U.S. or have already reached significant milestones there. This is based on a comprehensive analysis where we reviewed all press releases from Spanish startups that have raised over €10 million in the last five years.

What’s interesting about this trend is the range of sectors involved, from biotech companies chasing FDA approval or Spacetech companies partnering with SpaceX to Traveltech unicorn TravelPerk acquiring two US companies. And who would’ve guessed that Barcelona-based Solarmente, a clean energy startup, would bring Leonardo DiCaprio at its captable?

But before digging into Spanish startups’s ambitions in the US, let’s look a little closer to the Spanish ecosystem.

Over the past decade, the venture capital landscape in Spain has evolved significantly. Historically, Spain lagged behind other European countries in terms of startup investment. However, recent years have seen an increase in both the quantity and quality of venture capital funding. In 2023, Spanish startups raised more than $2.2 billion in venture capital, maintaining high levels despite global economic uncertainties. The combined enterprise value of Spanish startups surpassed €100 billion in 2023, reflecting a 3.6x increase since 2018. When looking at significant rounds ( >10 millions dollars), Spain has been following the same growth trajectory as other main European countries such as France or Germany, and shows no signs of delay.

These funding rounds are driven by a diverse mix of investors, including those from Spain, broader Europe, and the United States, with the investor profile often varying depending on the startup's growth stage. Clarity AI, one of Spain's standout successes in US expansion, illustrates this well: the company secured its initial funding through Spanish investors like Kibo and Seaya in pre-seed and seed rounds. As it grew, Clarity AI attracted a €15 million Series A led by non-Spanish European investors, Deutsche Börse. And then, its subsequent €50 million Series B round was backed by major American investors, including BlackRock. Now Clarity has become the global leading sustainability tech company and more than 10% of its workforce is based in the US.

Interestingly, recent data from the Dealroom report highlights a little shift in these typical funding stories: American investors are no longer the dominant force in growth-stage rounds.

For instance, we’ve seen companies such as cloud analytics and security platform Onum raising large Series A ($28m) with both European investors Dawn and American investors Insights Partners, with the clear will to tackle the US market.

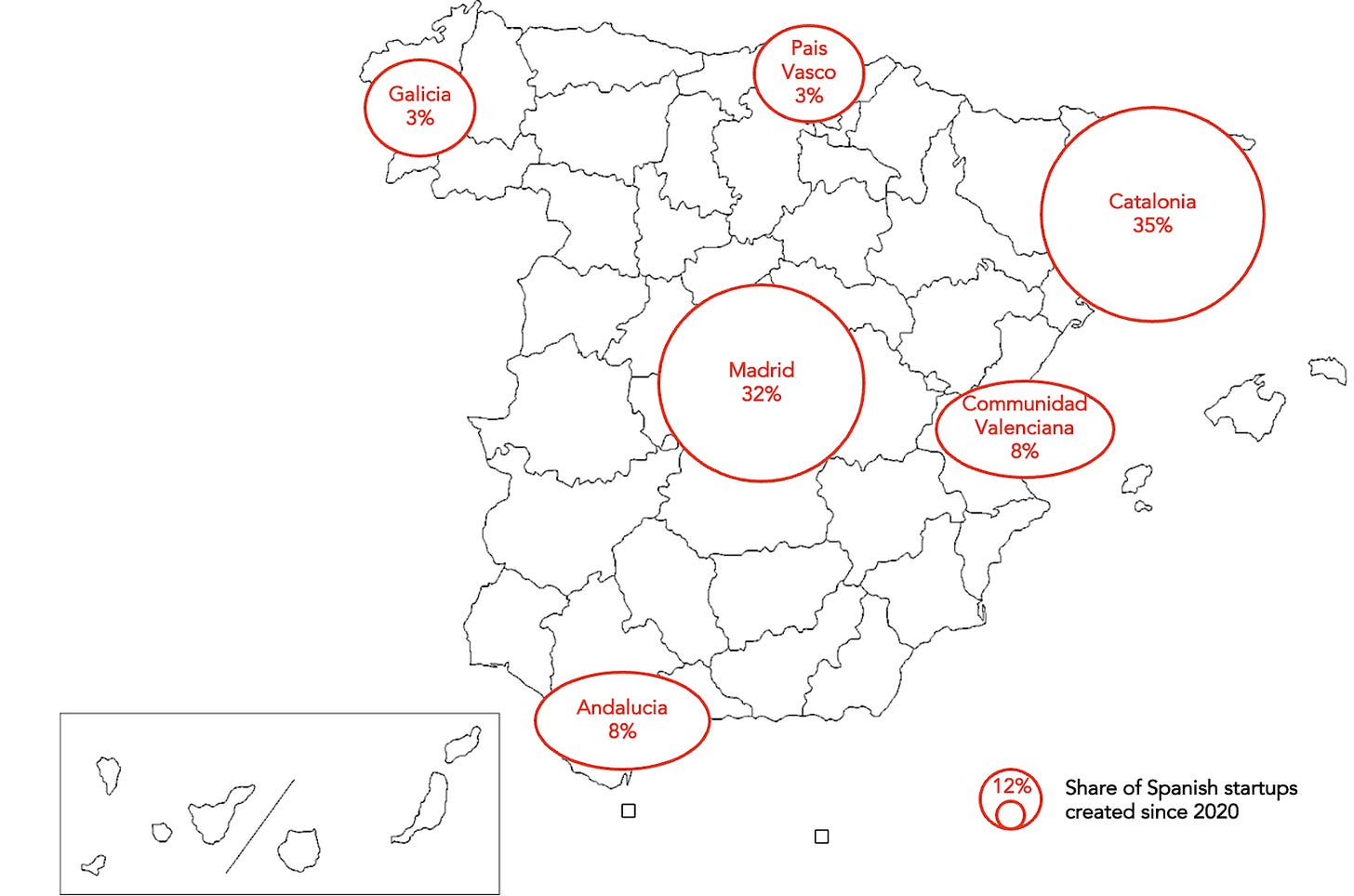

In terms of geography, Barcelona and Madrid remain the primary hubs, with Barcelona hosting over 35% of Spain's startups and Madrid (32%) leveraging its political and economic centrality to attract significant investment.

Beyond these main hubs, other cities are emerging as notable players. Málaga, for example, has been investing in its tech and innovation infrastructure, with Málaga TechPark hosting numerous tech companies and startups. Valencia (where 6% of new Spanish startups were created since 2020) is becoming a hotspot for sectors such as biotechnology, agritech, and fintech, offering a favorable business environment with lower operating costs compared to Barcelona and Madrid. Bilbao, historically known for its industrial base, is transforming into a tech and innovation hub, supported by institutions like the Basque Government.

So now, how do you go from Barcelona, Madrid or Valencia to the US?

Generally speaking, when a startup looks to expand internationally, they take a gradual approach—establishing a go-to-market strategy, building out a hiring plan, and so on. However, expansion through M&A can sometimes accelerate the process. We know this firsthand from our partners Alfred and Antoine, who used this exact strategy to break into the US market when they were entrepreneurs. This approach can also work for Spanish companies. Let’s take a closer look at two notable Spanish startups that pursued US expansion through M&A strategies:

Barcelona based TravelPerk's expansion into the U.S. market has been driven by 2 strategic acquisitions of US based companies: NexTravel and AmTrav. In January 2021, TravelPerk acquired NexTravel, a business travel platform serving over 700 clients, including companies like Yelp and Stripe. This acquisition significantly bolstered TravelPerk’s presence in the US by adding NexTravel's technology, customer base, and market expertise, positioning TravelPerk as a stronger player in the post-pandemic business travel market. Then, in June 2024, TravelPerk acquired AmTrav, a Chicago-based travel management company with a 30-year history of innovation in the US market. This acquisition doubled TravelPerk's US revenue and expanded its operational footprint to include key locations such as Boston, Los Angeles, and Miami.

On the other hand, Wallapop's attempt to expand into the U.S. market through a merger with LetGo in 2016 was in the end not such a success story. The merger aimed to combine resources and user bases to challenge dominant players like eBay and Craigslist in the competitive US marketplace. Wallapop, which had already gained significant traction in Europe, saw the US as a key market for growth and viewed the merger as a strategic move to establish a strong foothold. However, the combined entity struggled to gain the necessary market share against other competitors like OfferUp, which had already established a robust presence. Both Wallapop and LetGo invested heavily in advertising and user acquisition, but the results were underwhelming. By 2018, Wallapop decided to sell its stake in the joint venture for $189 million, effectively ending its US expansion efforts.

Beyond M&A, other Spanish startups have opted for strategic partnerships or different market focuses. For example, in the summer of 2024, spacetech company Sateliot partnered with SpaceX to launch four satellites, marking a significant step into the US market. Similarly, travel gear brand Tropicfeel became an Amazon US Selling Partner, leveraging the platform to boost its sales strategy in the US market.

Interestingly, not all Spanish startups have targeted the US as their primary market for expansion. TicketBis, for example, specialized in the purchase and sale of event tickets and focused on emerging markets. This strategy attracted the attention of its major US competitor, leading to its acquisition by eBay in 2016. Likewise, Amenitiz, a hospitality management platform, or Innovamat, an ed-tech startup focused on math learning, have chosen to first expand into Latin America, a market with structural similarities to Europe, before tackling the US market.

Indeed, Latin America may often appear to be a more favorable market than the US for Spanish startups due to the shared language and cultural similarities. However, expanding into the region is not always straightforward for two key reasons: the cultural and linguistic connections are often less deep than they seem, and the market is highly fragmented across numerous distinct countries. Moreover, when it comes to market size, the US clearly presents a larger and more lucrative opportunity. Even though it may seem more challenging, the rewards of entering the US market can far outweigh the difficulties.

But that’s it for now, and we’ll dive specifically into these challenges for Spanish startups that are thinking about expanding in the US in another article, stay tuned!

What’s for sure is that the future is bright for Spanish startups. With increasing international interest and substantial growth in venture capital, Spain is assured to produce even more global success stories in the years to come. Investors looking to tap into Europe’s next big tech wave should definitely keep an eye on this rapidly maturing ecosystem.

CM