Red River Insights - October 2024

Dear Friends,

At Red River West, we constantly strive to stay ahead of emerging trends, leveraging our tech platform RAMP to surface insights and explore trending tech industries. This month, we turn our attention to an area that has been gaining momentum in the European ecosystem as well as globally: defence tech.

Disclaimer: while we are intrigued by the broader developments in this space, Red River West carefully evaluates opportunities to ensure they are not directly and primarily linked to the production of weapons or munitions. If we were to invest in Defence, our focus remains on technologies that enhance security and defence capabilities, with a strict criteria for non-lethal innovations.

Our goal is to provide you with a clear and informed perspective on this fast-evolving sector.

Since 2020, European defence tech funding has increased fivefold. This year it is on track to reach 1B€ by the end of the year, it now accounts for 1.8% of VC funding in Europe, up from 0.4% in 2022. This surge in investment reflects a growing commitment to strengthening defence capabilities across Europe. The establishment of funds like the 1B€ NATO Innovation Fund (NIF) and increased spending by the European Commission to modernise Europe's armed forces, underscore this trend. However, stats like this are hard to ignore: The US provided more than 65% of venture capital defence tech investment in Europe so far this year (Financial Times).

Some define defence tech by its main intended purpose—whether for commercial or military use—while others focus on the revenue split between commercial and military applications. Others argue that defence tech, especially dual-use, is inseparable from deeptech (source)… To define it more clearly, we have chosen to focus on defence tech as encompassing a broad spectrum of technologies aimed at enhancing national security and defence operations, focusing specifically on innovations that directly assist military forces and defence agencies. This includes autonomous weapons systems, advanced aerospace and naval technologies, AI-driven defence applications, surveillance and intelligence tools, and space-based defence initiatives.

For this newsletter, we have intentionally excluded broad-based players like general cybersecurity or satellite companies that don’t explicitly focus on defence.

reminder: this is an algorithmic scoring, not a random human judgment!

We also have exciting news at Red River West with a new investment in a new country and lots happening in our portfolio!

RAMP's Global Defence Top10

We hope this sparks interesting conversations. If you have any comments or would like to suggest a startup that should be included, feel free to reach out to us. Abel, Chloé, Joseph and Olivier will be delighted to discuss these trends and rankings.

(Ranking established on 15/10/2024)

1. Integration of AI in Defence

European companies are increasingly integrating AI into defence systems, enhancing operational capabilities and decision-making processes. Helsing leverages AI to analyse large volumes of data from sensors and weapons systems, delivering real-time battlefield intelligence to support military decision-making. Additionally, its software is being utilised to enhance AI capabilities for drones deployed in Ukraine.

Similarly, Comand AI empowers defence forces with advanced decision-making and operational capabilities through AI-driven platforms.

Startups like Delian Alliance Industries (former Lambda Automata) combines cutting-edge robotics and sensor hardware with proprietary autonomy software to neutralize physical threats at machine speed. Its autonomous surveillance towers are already deployed in mission-critical roles like coastal surveillance.

AI in modern warfare is expected to be a massive market, projected to reach > 100B$ by 2032, with a CAGR of 30%. As governments and militaries invest in AI technologies, this space could become a critical opportunity for tech and defence companies alike (Allied Market research)

2. Advancement of Autonomous Unmanned Systems and Weaponized Drones

The development of autonomous unmanned systems, including weaponised drones, is accelerating in Europe. Quantum Systems GmbH specialises in electric vertical takeoff and landing (eVTOL) unmanned aircraft that offer extended range and versatility. Their drones combine the advantages of helicopters and airplanes, providing advanced capabilities for surveillance and reconnaissance missions.

ARX develops autonomous unmanned systems for dual-use applications, enhancing both military and civilian capabilities through advanced technology. A significant development in this area is the formation of the UXS Alliance between ARX Robotics and Quantum Systems. This alliance aims to create synergies and align their products and technologies to bring Unmanned x Vehicle (UxV) systems to the market faster. By combining their expertise, they enhance operational capabilities and drive innovation in unmanned systems. Unmanned Defence Systems (UDS) focuses on delivering next-generation, cost-efficient unmanned aerial systems (UAS) compliant with modern warfare doctrines. Their expertise covers areas related to autonomous systems, GNSS-denied environment navigation, AI, and computer vision. Shark Robotics creates terrestrial robots, including unmanned ground vehicles (UGVs), designed for hazardous environments and defence missions. These robots perform tasks too dangerous for humans, reflecting the increasing reliance on unmanned systems in modern defence strategies.

The investment by Sequoia in Stark Defence is particularly noteworthy (a recent 14M€ Series A). Sequoia's entry into European defence tech signifies a growing acceptance and recognition of the sector's importance, especially in the area of weaponised systems like loitering munitions. While Stark Defence is still early-stage and lacks sufficient public data to build a Ramp momentum score with a strong confidence index, its huge potential suggests it might soon make the top 10!

3. Counter-Drone Technologies and Airspace Security

With the proliferation of commercial drones, the need for counter-drone technologies has surged. European companies are developing advanced solutions to address this challenge. MyDefence AS provides cutting-edge drone detection and mitigation solutions, leveraging radio frequency technology to protect against unauthorised UAVs. Their systems are designed for flexible deployment in various scenarios, enhancing airspace security.

Similarly, CERBAIR develops real-time anti-drone platforms using radio frequency analysis, image recognition, and jamming to secure both public and private airspace. By using state-of-the-art technologies, they enable clients to monitor and protect against rogue drones effectively.

The counter-drone market is expected to grow from 1.2B$ in 2021 to 7B$ by 2029, at a CAGR of 30% (MarketsandMarkets).

4. Space-Based Surveillance and Maritime Security

Space-based surveillance is becoming essential for maritime security, and European companies are leading in this area. Unseenlabs is revolutionising maritime surveillance by using satellites to monitor oceans and detect rogue vessels, even those that turn off their Automatic Identification System (AIS) beacons. By geolocating electromagnetic signals emitted by ships, Unseenlabs provides critical data to combat illegal activities such as smuggling, illegal fishing, and piracy.

Their services enable clients to locate all boats and non-cooperative entities sailing the seas for illegal operations, enhancing global maritime domain awareness. The global maritime surveillance market is projected to reach 30B$ this year (MarketsandMarkets).

More on RAMP's scoring method

The ranking of these startups is based on the estimated momentum of the company but the algorithm does not assess the quality or reliability of the products/solutions developed by these companies!

Find out about the algorithm behind this ranking and the way scores are calculated here: Cheat sheet on RAMP

All the previous Top 10 are here.

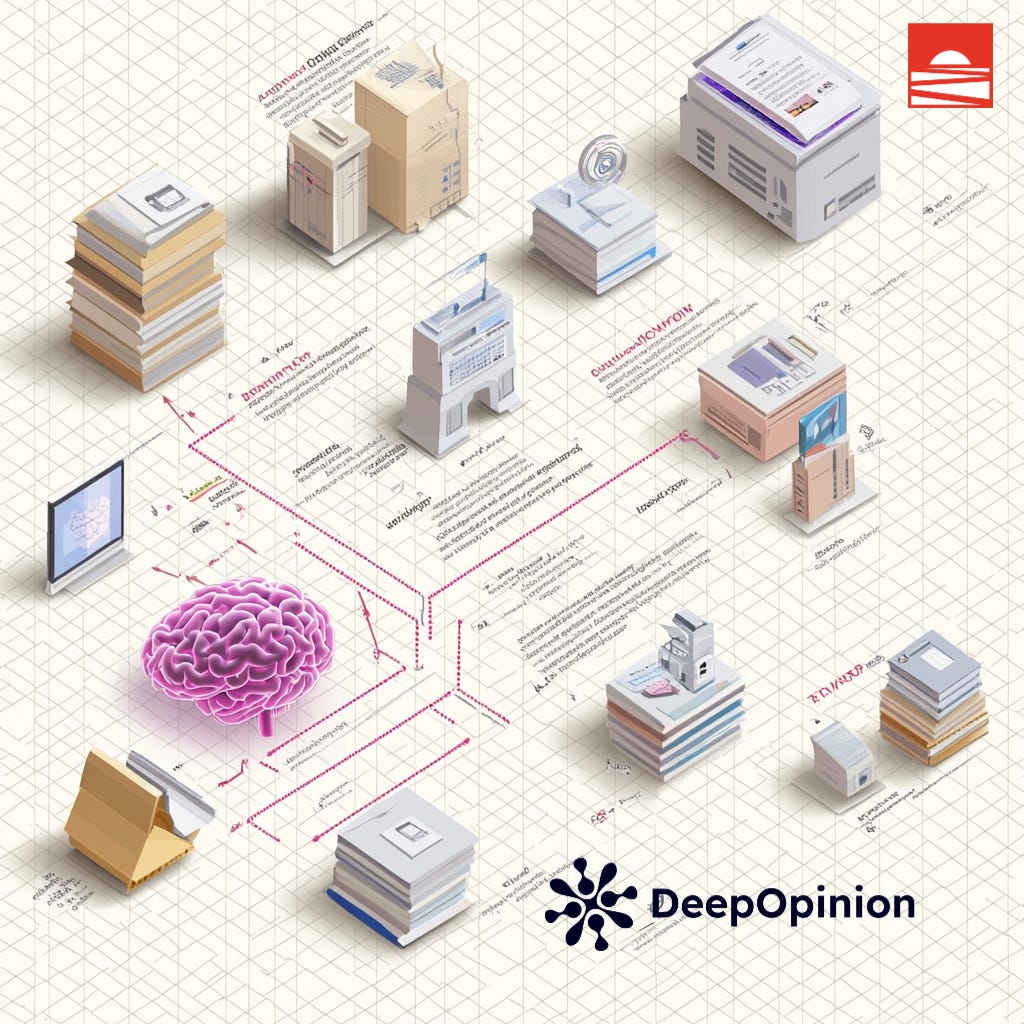

Leading DeepOpinion’s Series A: building the future of enterprise automation

We are thrilled to announce our investment in DeepOpinion, co-leading their 11M€ Series A round with our friends at Alpha Intelligence Capital.

DeepOpinion is building a generative automation platform that automates complex knowledge work processes. Combining Agentic AI, business process digitization, and no-code development, DeepOpinion enables teams to create sophisticated AI apps in minutes to achieve 90%+ automation efficiency in complex tasks. Read Abel’s excellent blog post on this topic here

Portfolio news

Ada was featured in the Harvard Business Review article "How AI Could Help Reduce Inequities in Health Care," highlighting their role in using AI to address healthcare disparities.

Le Collectionist achieved B Corp certification, recognising their commitment to social and environmental performance in luxury villa rentals.

Resilience was listed in the LinkedIn Top Startups 2024, honouring their innovation with over 160 employees dedicated to patients and caregivers.

Brut. won two awards at the Grand Prix Stratégies du Brand Content 2024: Silver for "Erasme" in "Institutional Communication," showcasing their integration of AI into creative practices, and Bronze with Visa for "The Creator Playground" in "Brand Experience."

Robovision, in collaboration with ISO Horti Innovators, introduced a cutting-edge AI-driven tulip planting system at Botania, Poland, revolutionizing horticulture with automated precision for optimal growth.

Speach announced a new Avatar AI feature allowing its clients to create a fully customized AI avatar in just 2 minutes, delivering messages in over 70 languages

Team news

November will be a busy month for the team. Abel and Joseph will be in Helsinki for Slush 2024, happening on November 20-21.

Meanwhile, Chloé will attend Web Summit 2024 in Lisbon, which takes place from November 11-14

We’re looking for our next full-time Data/Software Engineer to keep on leading the way in European data-driven VC, and incredible opportunity to build the future of investing! (Job offer)

You received this newsletter because we met or worked together and we thought you might be interested in an update, if we got it wrong, feel free to unsubscribe with the link at the end!